Do family companies perform better on the stock market?

Do you know what the companies Ford Motors, Lotus Bakeries, Nike and Walmart have in common? They are all family businesses. Is it important for investors to know this? Absolutely. In general, family companies think more on the long term, have a healthier balance sheet, are more profitable and perform better on the stock market.

First of all, we need to answer this question: what is a family business? In general, a family business is a company in which the founder or his/her descendants hold at least 20% of the shares or voting rights.

Family first. It is a statement you hear regularly. It is in human nature to prefer your own family above someone else. This is no different on a business level either. One of the major difficulties of investing is that the interests of you as a shareholder and the interests of the management are not always the same. Self-interest usually prevails when making business decisions. Does sponsoring a cycling team really offer added value for the company? Or does the CEO just love cycling events? Are the private jets the management has at its disposal really necessary? Or is it mainly because it is easy for them to reach their vacation destination? These are critical questions investors can and should ask themselves. At ACE we only invest in family companies with good corporate governance.

In this respect, family companies have an edge over other companies. Family businesses usually have one main goal: to transfer their business larger and stronger to the next generation. This will also benefit you as an investor because the focus lays on creating long-term shareholder value. The interests of management and those of you as a shareholder are therefore more equal.

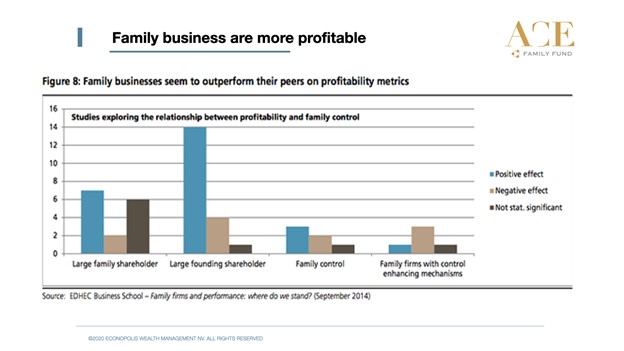

Higher profitability and faster growth

Hard figures prove that long-term thinking pays off when it comes to entrepreneurship. For example, a study by Credit Suisse shows that since 2006 the turnover growth of family businesses lays in general 2 percent higher than the annual turnover growth of other companies.

In addition, family-run businesses are also more profitable. Thus, the Return On Invested Capital (ROIC) is significantly higher. In concrete terms this means that these companies achieve to make more profit with the money that shareholders invest in the business. This phenomenon can be observed in Europe, Asia and North America.

Healthier balance sheet

Achieving an interesting return without taking excessive risks. That is what investing is all about. It's the same for entrepreneurs. Can you guess which companies have the most debt on their balance sheet? Family companies or non-family run businesses? Exactly. Companies in which the founding family still holds a significant stake generally finance themselves more with internal resources. These companies are using the profits they have already made to reinvest it in the company itself to achieve future growth. On the other hand, non-family managed companies use more debt to finance its operations. A lot of debt on the balance sheet of a company can be deadly in times of crisis. The healthier the balance sheet, the healthier the company. It prevents future liquidity and solvency problems.

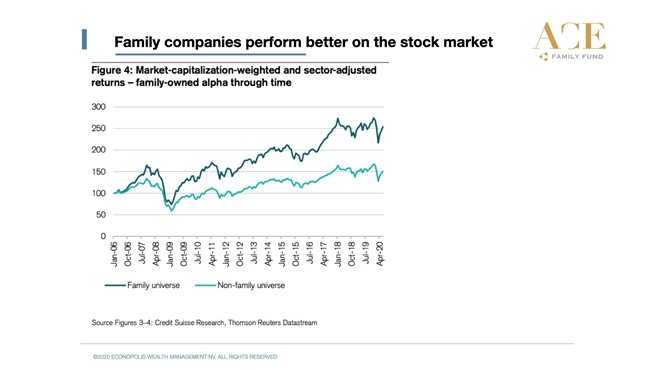

Stock market performance

Right now you already know that family-owned businesses have a better long-term vision, a healthier balance sheet and achieve a higher profitability and growth. The key question is whether this translates into a better stock market performance. It should come as no surprise that this actually is the case. For example, Credit Suisse concludes that since 2006 family businesses performed 3,70 percent better per year compared to non-family businesses. In Europe and Asia there even is an annual outperformance of no less than 4.70 percent.

Anyone who invests 1 million EUR today and achieves a return of 5% or 9.7% over the next 20 years, will end with an investment portfolio worth respectively 2.7 million EUR and 6,9 million EUR. A difference of no less than 4,2 million EUR.

When we talk about private equity (non-listed companies) family companies also perform better in general. Once again, the same principle applies: what you do with passion and for yourself, you usually do better. For example, there is a clear difference between the driving behavior of the driver of a company car and someone who bought his car with its own money. Company cars cause significantly more accidents than an identical passenger car (same brand, power, color, ...) of a driver who bought the car himself. You can also translate this to the stock market: the more the management owns of its own company, the greater the chance that the main focus will lay on creating shareholder value on the long term. You as an investor profit from this.